BTIG has raised its price target for crypto miner Core Scientific Inc (NASDAQ:) to $15 from $10, citing new data center contracts and growth potential in the mining sector.

BTIG’s BTC mining basket, comprising 14 companies, has an aggregate hash rate of about 138 EH, which represents 23% of the global hash rate. The hash rate is expected to grow to 153 EH by 2025, driven by new rigs that improve fleet efficiency.

Bitcoin’s price currently hovers around $62,000, up 45% year-to-date, with miners’ margins benefiting from higher prices. The global hash rate averaged 582 EH in June, down from 600 EH in May but up 57% from last year. Network (LON:) difficulty has steadily increased, up 60% over the past year and 16% year-to-date.

Meanwhile, Core Scientific announced a 200MW high-performance computing (HPC) contract with CoreWeave, followed by an additional 70MW of data center contracts. This news has driven Core Scientific’s stock up by nearly 90% in recent weeks. BTIG highlighted that the shift to fixed-price multi-year contracts allowed some miners to decouple from Bitcoin prices, which have dropped about 11% since early June.

“The pivot to fixed-price multi-year contracts has seen CORZ and some miners decouple from the BTC price, with Terawulf up over 100% and Iris up around 70% over this period,” BTIG stated.

The race for power access has intensified among publicly listed BTC miners due to increasing demand from data center companies. “For every 100MW of power converted or powered-up for HPC, that’s 5-6 EH less for the global hash,” BTIG noted.

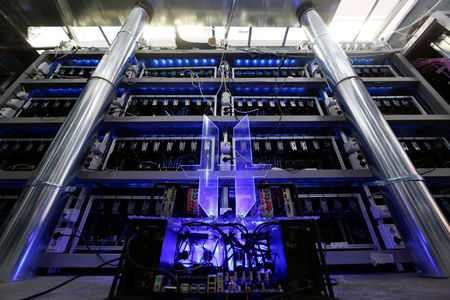

During site visits to Riot’s Corsicana facility, which targets around 1GW, and Core Scientific’s Denton facility, BTIG observed that the industrialization of BTC mining has arrived. Riot’s Corsicana facility is expected to reach 31 EH by the end of this year and 41 EH by 2025.

The report shed light on Bitdeer’s investor discussions, which revealed a focus on designing mining rigs and converting existing facilities for HPC computing. “The low-hanging fruit is its Washington facility, near a Microsoft (NASDAQ:) data center, with potential conversions in Ohio and Norway,” BTIG reported.

BTIG estimates the value of Core Scientific’s 286MW of fixed HPC contracts at $9-$10 per share, assuming a 15x EBITDA multiple. “Data center REITs are trading at about 20x EBITDA on 2025,” BTIG added. With a target of 500MW for HPC by 2028, BTIG expects an additional $5 per share value, justifying the new price target of $15.